DDP (Delivered Duty Paid)

DDP (Delivered Duty Paid) is one of the 11 Incoterms defined in the Incoterms 2020, published by the International Chamber of Commerce (ICC). It is an Incoterm that is commonly used in international trade when the buyer and seller are located in different countries and the seller is responsible for arranging and paying for the transportation of the goods to a named place at the destination, as well as handling all customs formalities, taxes and duties.

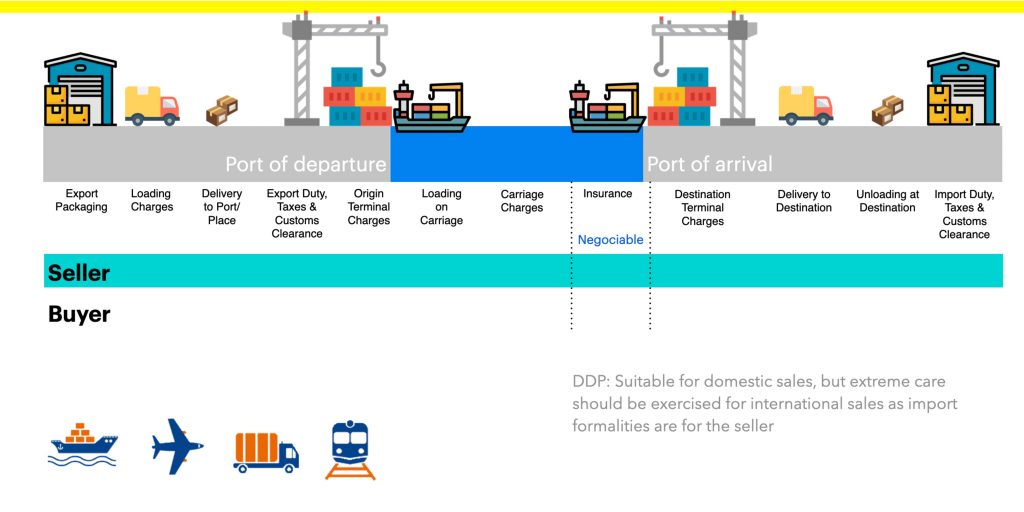

Under DDP, the seller is responsible for delivering the goods at a named place at the destination, obtaining any necessary export licenses or permits, unloading the goods at the place of delivery, and paying for any customs clearance and import duties. The buyer is only responsible for arranging and paying for the transportation of the goods from the place of delivery to the final destination. The risk of loss or damage to the goods passes from the seller to the buyer when the goods are delivered at the named place.

Responsibilities and Obligations of Buyer and Seller

- The seller's responsibilities under DDP include:

- Delivering the goods at a named place at the destination

- Obtaining any necessary export licenses or permits

- Unloading the goods at the place of delivery

- Arranging and paying for any customs clearance and import duties

- The buyer's responsibilities under DDP include:

- Arranging and paying for the transportation of the goods from the place of delivery to the final destination

- Bearing the risk of loss or damage to the goods once they are delivered at the named place

Advantages of using DDP include:

- The buyer has more control over the transportation arrangements as they can choose the carrier and mode of transportation

- The buyer can arrange for the goods to be shipped directly to the final destination, avoiding the need for transshipment

- The seller is not responsible for obtaining export licenses or permits

Disadvantages of using DDP include:

- The buyer bears all the risks and costs associated with the transportation of the goods

- The buyer is also responsible for obtaining any necessary licenses or permits and paying any applicable duties or taxes

Examples of when to use DDP include:

- When the buyer is located in a country with complex or restrictive import regulations and the seller has the experience and resources to navigate those regulations

- When the buyer does not have the resources or capabilities to handle customs clearance themselves

- When the buyer wants to avoid any import taxes or duties

- When the goods are perishable or require special storage conditions and the named place of delivery has the necessary facilities to meet those needs.

It’s important to note that DDP is the most advanced Incoterm among all the Incoterms defined in the Incoterms 2020 and it shifts most of the responsibilities and risks from the buyer to the seller. It’s important for both buyer and seller to carefully consider their capabilities and resources before choosing to use DDP in a trade agreement, and to consult with legal and logistics experts to ensure compliance with laws and regulations.

Additionally, it’s important to agree and specify the exact place of delivery, and any other relevant details in the sales contract. The buyer should also be aware that DDP does not include loading of the goods, so the buyer should consider this before using this Incoterm. It is also important for the buyer to check that the place of delivery is accessible for the type of transport used for the goods and that the seller has the necessary experience and resources to handle customs clearance and import duties.